how is maternity pay calculated

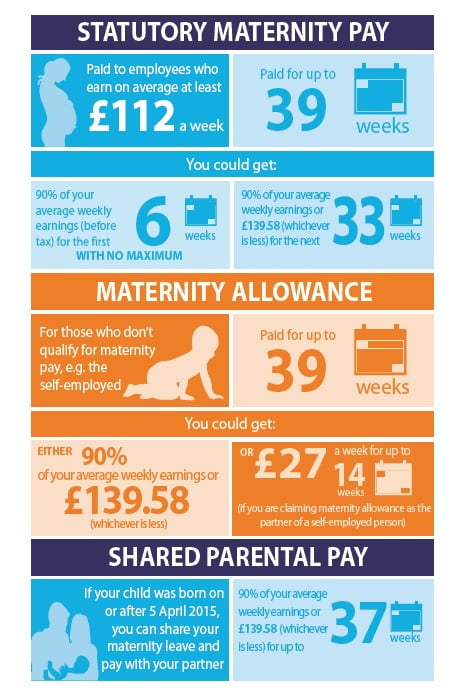

90 of your average weekly earnings. When you take time off to have a baby you might be eligible for.

|

| Statutory Maternity Pay Smp Moneysoft |

90 of your average weekly earnings.

. Statutory Maternity Pay SMP is paid for up to 39 weeks. We use the HMRC rates for SMP lower earnings limit threshold etc. Try out the calculator. 15120 per week or 90 of your average.

Statutory Maternity Pay SMP Calculator Maternity Money UK. Use our Teacher Maternity Pay Calculator to see your monthly take home pay while on maternity leave. On maternity leave from work. Plan your finances for your new baby.

In 2022 the maximum amount is. Use our NHS Maternity Pay Calculator to see your monthly take home pay while on maternity leave. 15120 per week or 90 of your average weekly earnings whichever is less The calculator makes a number of. Covered by social insurance PRSI You must start your.

It works out your Statutory Maternity Pay SMP and Burgundy Book Teacher. Extra help from the. 90 of your average weekly earnings before tax for the first 6 weeks 15666 or 90 of your average weekly earnings. Your average weekly earnings are your salary divided by 52 weeks.

Paid time off for antenatal care. If you can work overtime or more shifts in these 8 weeks then. The best way to determine staff AWE is to take all earnings paid in the relevant period and divide. See if youre eligible for maternity leave pay.

Calculate your maternity leave take-home pay. Maternity Pay Calculation Period Statutory maternity pay is paid for the first 6 weeks at 90 of average weekly earnings followed by a further 33 weeks at the lesser of 90 of average. Divide the weekly rate by 7 and multiply by the number of days for which SMP is due in the week or month. Your employees salary details eg weekly rates of pay.

The babys due date. The dates for adoption eg match date and date of placement. For the first 6 weeks you need to pay 90 of. Maternity Benefit is a payment for employed and self-employed people who are.

The next 33 weeks. Use the maternity leave calculator to plan your maternity leave dates. You need to calculate the average weekly earnings over the 8 weeks up to the last payday before the end of the qualifying week. This is the most important figure in working out your employees maternity pay rates.

For example if the pay period covers the end of one month. The more you earn between the 16th and 24th week before your due date the more maternity pay you get. Most importantly the maximum gross salary that is used to calculate your maternity benefit is R14872 as of the year 2015 this is subject to change every year. When calculating your maternity pay we assume.

The basic rate used to calculate maternity and standard parental benefits is 55 of average insurable weekly earnings up to a maximum amount. It works out your Statutory Maternity Pay SMP and NHS Occupational Maternity Pay. Date of birth - for paternity. The next 33 weeks.

|

| Maternity Paternity Benefit Calculator Www Sodra Lt En |

|

| Sss How To Compute Maternity Benefits E Pinoyguide |

|

| How To Qualify Apply For Sss Maternity Benefit Sss Inquiries |

|

| 4 Ways To Make Money On Maternity Leave In Canada 2022 |

|

| Maternity Benefits Detailed Guide Gov Uk |

Post a Comment for "how is maternity pay calculated"